In recent years, plant-based alternatives to meat products have witnessed a dramatic increase in popularity. The United States, in particular, has seen a shift in consumer demand for plant-based proteins designed to look and taste like meat, spurring the success of companies such as Beyond Meat and Impossible Foods.

Early indications suggest demand for plant-based meat alternatives is likely to accelerate when the Covid-19 outbreak is over. In the past five years, products like the JUST plant-based egg, Impossible Foods Burger and the Beyond Meat Burger have grown in popularity as a way for consumers to decrease their personal environmental footprint and reduce animal suffering. Additionally, studies have shown that a transition from red meat to plant-based foods may lower the risk for chronic disease and mortality among consumers. While alternative meat is more costly than animal protein options, prices have been dropping quickly and in some product categories they are the same prices as animal protein products.

However, when considering a transition towards alternative meat, food industry leaders must utilize a more holistic, systems approach. Crises like COVID-19 emphasize that our current protein supply chain rely on centralized supply chains that lack the flexibility to switch between interchangeable food products. For example, disruptions in the food supply chain could limit access to products like beef as we have seen in the US. Alternative meat, in addition to its potential for lowering agricultural carbon emissions and serving as a healthy protein option, also diversifies our protein portfolio. As such, utilizing new food technology decreases the vulnerability of our protein system amid crises like the coronavirus.

JP Morgan has estimated that the market for plant based meat could easily top 100 billion USD in 15 years. Barclays says the “alternative meat” market could account for around 10 per cent of all global meat sales, or up to $140 billion in 10 years. Among big restaurant chains, Burger King has launched a vegetarian version of its flagship “Whopper,” while McDonald’s has unveiled a meatless burger in Germany. Kentucky Fried Chicken has begun to roll out its plant based fried chicken in the US. Giant food and commodity players like Nestles, Kellogg, Danone, Cargill and ADM have also launched new alternative protein products and brands.

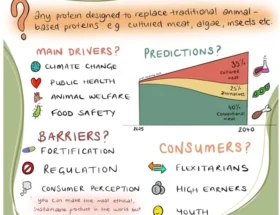

Over the past year, meat alternatives have made inroads in the Middle East, particularly in the United Arab Emirates which have been in response to growing consumer demand. A report released in 2019 by consulting firm AT Kearney indicated that companies producing meat alternatives have the potential to “disrupt the multibillion-dollar global meat industry.” The study suggested that by 2040, most meat consumed by humans will not come from slaughtered animals, but rather from plant-based alternatives or cultured meat—that is, grown from animal cells in labs. Major food brands in the Middle East are also now ramping up efforts to produce meat-alternative products to compete with companies like Beyond Meat and Impossible Foods. The arguments for going meat-free are varied. Some adopt plant-based diets for health reasons, others over growing concerns about the significant environmental impact of meat production and animal welfare. Although many of the new meat-alternative products are suitable for vegans, they have also been developed for mass appeal.

The Middle East and Africa Meat Substitutes Market (2019) report on the meat substitute market in the Middle East and Africa states that the market is expected to grow with a CAGR of 9.84% in 2019-2027. South Africa, Turkey, Saudi Arabia, the United Arab Emirates and countries in rest of MEA together comprise the market for meat substitutes in Middle East and Africa.

In Egypt, there is already many options in the traditional food that are vegetarian/vegan: items such as koshary ( a dish consisting of lentils, cheapea, pasta and rice), ta’meya which is similar to falafel but made with fava beans, foul ( fava beans dish), date biscuits are all popular options. Zooba, one of Egypt’s leading food chains serving popular street food dishes, and recently expanding its operations to New York City, offers all these options and many others that are vegetarian and vegan. Mr. Mustafa El Refaey, Zooba’s Executive Chef and Cofounder, confirmed that there is interest and increasing trend for vegetarian/non-meat dishes, and that the current traditional Egyptian cuisine offers many options. For alternative meat options, this is still a relatively new trend in Egypt, with some of the niche restaurants and companies starting to make this option available such as meatless burgers. But as in other parts of the world, Egypt and the MENA region can also expect the global leaders in this space beginning to make there products available.

The market for alternative proteins and meats will grow rapidly in the Middle East over the next decade. This will be driven by consumer awareness, concerns over climate change and the growing interest in health and wellness. There is a lot of room for expansion, innovation and investment is this area in the Middle East. There is space and room in this market that will need to be filled with new and innovative companies, including start-ups that can respond to this new movement. The region is on the cusp of change that will bring people to view food with a more conscious engagement and a transformation of eating habits for the current and future generations.

Written by: Marc Van Ameringen and Nada Elhusseiny from the Future Food Platform

__________________________________________

Future Food Platform is based in Geneva, Switzerland and Ottawa, Canada. It is a network of global experts supporting food innovations around the world that can have a dramatic impact on environmental sustainability, human health and nutrition. The team works with start-ups, corporate partners and investors to bring food innovations to scale. See www.futurefoodplatform.com